We get to know your business to help grow your business

The SBA 7(a) loan is the SBA's most flexible business loan program. It can be used for a variety of general business purposes such as purchasing real estate and equipment, refinancing, making tenant improvements, making a business acquisition, accessing working capital and more.

-

Competitive Rates

Competitive Rates

-

Convenient Terms

Convenient Terms

Details

SBA 7(a) Financing

- Up to $5,000,000

- Loan Terms: 7-25 years

- LTV: up to 85%

- Nationwide Lending

With an SBA loan you can:

- Purchase or refinance commercial real estate

- Acquire a business or buy-out a partner

- Purchase equipment

- Make tenant improvements

- Refinance debt

Subject to credit approval. Terms and conditions may apply.

Business Types

- Assisted Living

- Car Washes

- Gas Stations

- Hospitality

- Restaurants

- Liquor Stores

- Child Day Care

- Medical / Dental

- Office / Industrial

- Athletic Facilities

- Retail Stores

- Auto Repair / Service

- Manufacturing

- Warehouses

- Funeral Homes

- Self-Storage

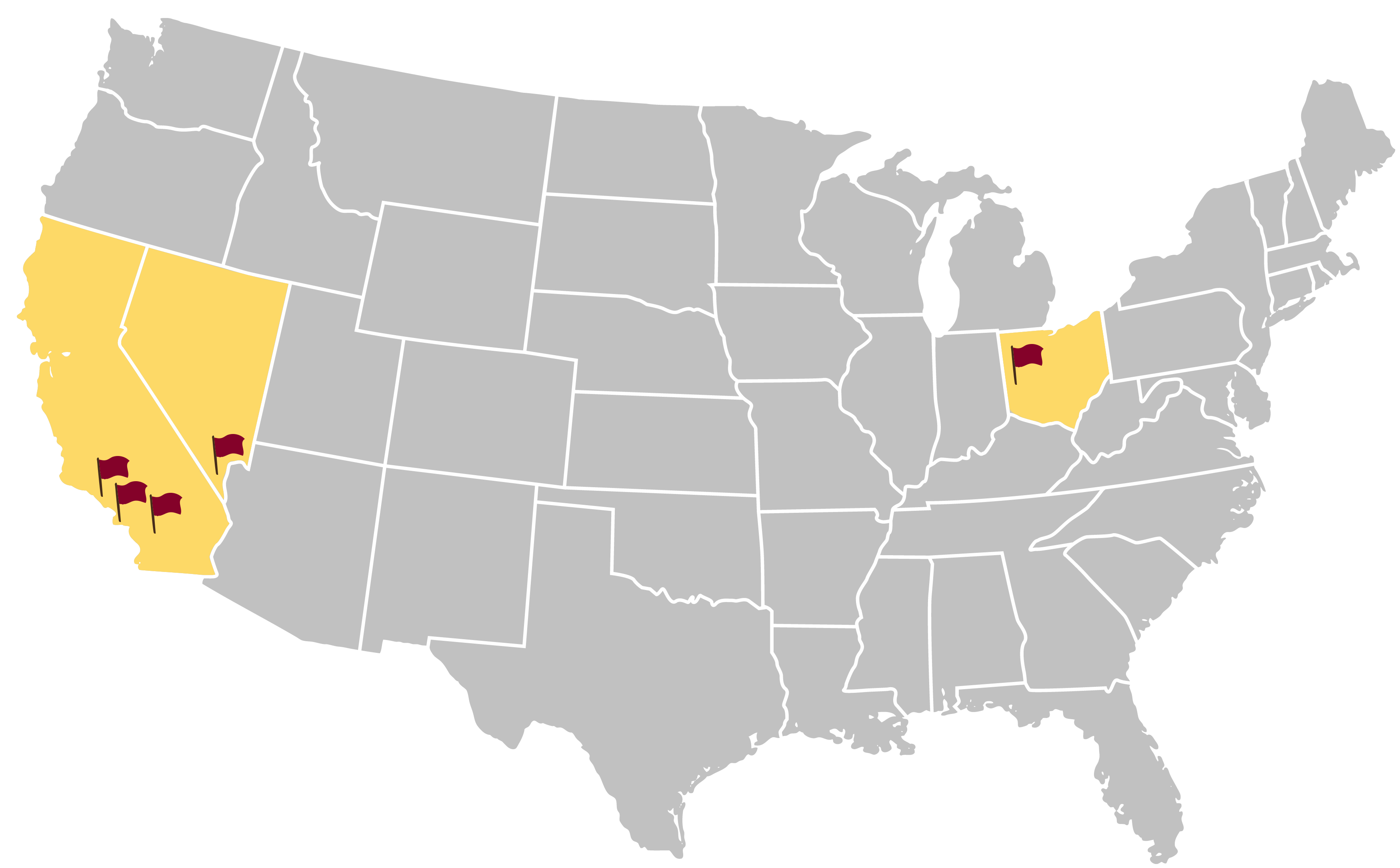

Recent Deals

Real Estate Acquisition

Industrial Building

$1,945,000

Piqua, OH

Business Acquisition

Machine Shop

$1,919,000

Perris, CA

Partner Buyout

Restaurant

$730,000

Henderson, NV

Real Estate Acquisition

Medical Office

$1,000,000

Lomita, CA

Working Capital

Law Office

$185,000

Los Angeles, CA

Contact a Professional

Western U.S.

310.948.3060

Southwest U.S.

310.948.3060